China is the world’s largest exporter and second-largest importer of goods. Its trade volume reached $4.65 trillion in 2020, accounting for 12.8% of the global total. China’s trade relies heavily on maritime shipping, as 90% of its goods travel across the ocean to reach their destination. Therefore, China’s shipping routes are vital for its economic development and global influence.

In this article, we will explore the main shipping routes that connect China with the rest of the world, their key trade lanes and ports, and their economic implications for China and its trading partners.

The Pacific Route

The Pacific route is the most important shipping route for China, as it connects China with its largest trading partner, the United States, as well as other major markets in North America, Latin America, Oceania and East Asia. According to the World Shipping Council, the top three container trade lanes in the world in 2019 were all on the Pacific route: Asia-North America West Coast, Asia-North America East Coast and Intra-Asia.

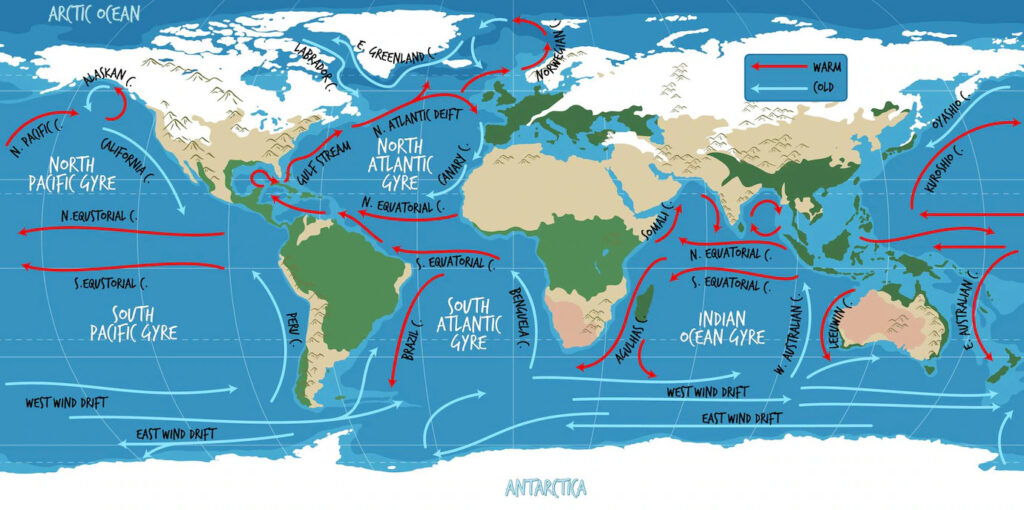

When taking the Pacific route, the ships will go through the south of the East China Sea. Then they go northward through the Sea of Japan through the Okhotsk to enter the North Pacific Ocean. Via this route the ships can reach the west of Latin America, the west of the U.S., New Zealand, Australia and western Canada.

Some of the key ports on the Pacific route are:

| Port | Country | TEU (2020) | Rank (2020) |

|---|---|---|---|

| Shanghai | China | 43.5 million | 1 |

| Ningbo-Zhoushan | China | 28.7 million | 3 |

| Shenzhen | China | 25.2 million | 4 |

| Busan | South Korea | 21.9 million | 6 |

| Hong Kong | China | 18.3 million | 7 |

| Qingdao | China | 18.3 million | 8 |

| Guangzhou | China | 18.2 million | 9 |

| Tianjin | China | 16 million | 10 |

| Los Angeles | U.S. | 9.2 million | 17 |

| Long Beach | U.S. | 8.1 million | 21 |

The Pacific route is crucial for China’s export-oriented economy, as it accounts for more than half of its total container throughput. The U.S. is China’s largest export market, absorbing $451.8 billion worth of Chinese goods in 2020, followed by Hong Kong ($279 billion), Japan ($149.2 billion) and South Korea ($136 billion). The Pacific route also enables China to import raw materials and energy resources from countries such as Australia, Canada and Chile.

However, the Pacific route also faces some challenges and risks for China’s trade security. First, there are geopolitical tensions and disputes in the East and South China Seas, where China claims sovereignty over islands and waters that are also claimed by neighboring countries such as Japan, Vietnam and the Philippines. These disputes could escalate into military conflicts that could disrupt or block China’s shipping lanes.

Second, there are environmental hazards and extreme weather events that could affect the safety and efficiency of maritime shipping on the Pacific route. For example, typhoons, earthquakes, tsunamis and volcanic eruptions could damage ports and ships or cause delays and detours.

Third, there are market fluctuations and trade frictions that could reduce the demand and profitability of China’s exports on the Pacific route. For example, the COVID-19 pandemic has caused disruptions in the global supply chain and a backlog of shipping containers at U.S. ports. The U.S.-China trade war has also imposed tariffs and sanctions on some Chinese products and companies.

The Atlantic Route

The Atlantic route is another important shipping route for China, as it connects China with Europe, Africa and parts of Latin America. According to the World Shipping Council, some of the major container trade lanes on this route are Asia-Europe (including Mediterranean), Asia-Africa (including Middle East) and Asia-East Coast South America.

When taking the Atlantic route, the ships will go through either the Suez Canal or the Cape of Good Hope to enter the Atlantic Ocean. Via this route the ships can reach Europe via Gibraltar or North Sea ports; Africa via Djibouti, Mombasa or Cape Town; and Latin America via Brazil or Argentina.

Some of the key ports on the Atlantic route are:

| Port | Country | TEU (2020) | Rank (2020) |

|---|---|---|---|

| Rotterdam | Netherlands | 14.3 million | 11 |

| Antwerp | Belgium | 12 million | 13 |

| Hamburg | Germany | 8.5 million | 19 |

| Valencia | Spain | 5.4 million | 30 |

| Algeciras | Spain | 5.1 million | 32 |

| Djibouti | Djibouti | 1.2 million | 61 |

| Mombasa | Kenya | 1.4 million | 88 |

| Cape Town | South Africa | 1 million | 96 |

| Santos | Brazil | 4.2 million | 39 |

| Buenos Aires | Argentina | 2.3 million | 52 |

The Atlantic route is vital for China’s economic diversification and strategic expansion, as it allows China to access new and emerging markets in Europe, Africa and Latin America. Europe is China’s second-largest trading partner, with a bilateral trade volume of $649 billion in 2020. Africa is China’s third-largest source of imports, mainly of oil, minerals and agricultural products. China’s trade with Africa reached $192.7 billion in 2020. Latin America is also a growing market for China, with a trade volume of $315.8 billion in 2020.

Moreover, the Atlantic route is closely linked to China’s Belt and Road Initiative (BRI), a global infrastructure and development project that aims to connect China with over 60 countries across Asia, Europe and Africa. Many of the ports and shipping lanes on the Atlantic route are part of the BRI’s Maritime Silk Road, which seeks to enhance China’s maritime connectivity and influence in the region.

However, the Atlantic route also poses some challenges and risks for China’s trade interests. First, there are geopolitical rivalries and competition with other major powers such as the U.S., EU and India, who also have strategic interests and presence in the region. These powers could challenge or counter China’s influence and activities on the Atlantic route, such as by imposing sanctions, conducting naval patrols or supporting local allies.

Second, there are security threats and instability in some of the countries and regions along the Atlantic route, such as piracy, terrorism, civil wars and political unrest. These threats could endanger the safety of Chinese ships and personnel or disrupt the operation of Chinese-funded ports and projects.

Third, there are social and environmental concerns and criticisms regarding China’s trade and investment practices on the Atlantic route, such as debt sustainability, labor standards, human rights and environmental protection. These concerns could erode China’s reputation and goodwill among its trading partners or trigger backlash and resistance from local communities and civil society groups.

The Indian Ocean Route

The Indian Ocean route is a relatively minor shipping route for China, as it mainly serves as a transit route between the Pacific and Atlantic routes or as a supplementary route for some niche markets in South Asia, Southeast Asia and Oceania. According to the World Shipping Council, some of the minor container trade lanes on this route are Asia-Australia/New Zealand, Intra-Southeast Asia and Intra-Indian Subcontinent.

When taking the Indian Ocean route, the ships will go through either the Malacca Strait or the Lombok Strait to enter the Indian Ocean. Via this route the ships can reach India via Mumbai or Chennai; Southeast Asia via Singapore or Jakarta; Australia via Sydney or Melbourne; or New Zealand via Auckland or Wellington2.

Some of the key ports on the Indian Ocean route are:

| Port | Country | TEU (2020) | Rank (2020) |

|---|---|---|---|

| Singapore | Singapore | 36.9 million | 2 |

| Tanjung Pelepas | Malaysia | 9.8 million | 16 |

| Port Klang | Malaysia | 8.3 million | 22 |

| Colombo | Sri Lanka | 7.2 million | 25 |

| Jakarta (Tanjung Priok) | Indonesia | 6.4 million | 28 |

| Nhava Sheva (Jawaharlal Nehru) | India | 5.1 million | 33 |

| Mundra Port & SEZ Ltd (Adani) Gujarat Pipavav Port Ltd (APM Terminals) Hazira Port Pvt Ltd (Adani) Kattupalli International Container Terminal Pvt Ltd (Adani) Krishnapatnam Port Container Terminal Pvt Ltd (Adani) Visakha Container Terminal Pvt Ltd (DP World) Chennai International Terminals Pvt Ltd (PSA International) Dakshin Bharat Gateway Terminal Pvt Ltd (ICTSI) Cochin International Container Transshipment Terminal (DP World) Kolkata |

The Challenges and Opportunities for China’s Shipping Routes

China’s shipping routes are not only vital for its trade and economic development, but also for its strategic interests and global influence. However, China also faces various challenges and risks on its shipping routes, such as geopolitical rivalries, security threats, environmental hazards, market fluctuations and social concerns. These challenges and risks could undermine China’s trade security and competitiveness, as well as its reputation and goodwill among its trading partners.

On the other hand, China also has some opportunities and advantages on its shipping routes, such as its state-backed shipping industry, its Belt and Road Initiative, its diversified trade and investment partners, and its technological innovation and digitalization. These opportunities and advantages could enhance China’s trade efficiency and resilience, as well as its connectivity and cooperation with other countries.

The State-backed Shipping Industry

China’s shipping industry has benefited from a complex and opaque system of formal and informal state support that is unrivaled in size and scope. According to a CSIS report, combined state support to Chinese firms in the shipping and shipbuilding industry totaled roughly $132 billion between 2010 and 2018, including financing from state banks ($127 billion) and direct subsidies ($5 billion). This does not include other forms of state backing such as indirect subsidies, state-backed fundraising, preferential borrowing rates, and other nonmarket advantages from China’s state capitalist system.

This state support has enabled Chinese firms to dominate across the entire maritime supply chain, producing 96 percent of the world’s shipping containers, more than 80 percent of the world’s ship-to-shore cranes, receiving 48 percent of the world’s shipbuilding orders in 20201, controlling the world’s second-largest shipping fleet by gross tons, and owning seven of the ten busiest ports in the world (including Hong Kong)1.

This state-backed shipping industry gives China a competitive edge over other countries in terms of cost, capacity, quality and reliability. It also gives China more leverage and influence over global trade rules and standards, as well as over the operation and management of strategic ports and shipping lanes.

The Belt and Road Initiative

China’s Belt and Road Initiative (BRI) is a global infrastructure and development project that aims to connect China with over 60 countries across Asia, Europe and Africa. Many of the ports and shipping lanes on China’s shipping routes are part of the BRI’s Maritime Silk Road, which seeks to enhance China’s maritime connectivity and influence in the region.

The BRI offers China some opportunities and advantages on its shipping routes, such as:

- Expanding its market access and diversifying its trade and investment partners

- Improving its infrastructure quality and efficiency along the shipping routes

- Increasing its soft power and goodwill among participating countries

- Promoting regional cooperation and integration on trade and development issues

The Diversified Trade and Investment Partners

China has been actively expanding its trade and investment relations with various countries and regions along its shipping routes, especially with emerging markets in Africa, Latin America and Southeast Asia. China has also signed several free trade agreements (FTAs) or regional trade arrangements (RTAs) with some of these countries or regions, such as the Regional Comprehensive Economic Partnership (RCEP), the China-Africa Free Trade Zone (CAFTZ), the China-Chile FTA, the China-Singapore FTA, etc.

These diversified trade and investment partners offer China some opportunities and advantages on its shipping routes, such as:

- Reducing its dependence on a single market or region

- Enhancing its resilience to external shocks or disruptions

- Exploring new sources of growth and innovation

- Balancing its trade surplus or deficit with different partners

The Technological Innovation and Digitalization

China has been investing heavily in technological innovation and digitalization in the maritime sector, such as smart ports, autonomous ships, blockchain-based logistics platforms, artificial intelligence-based navigation systems, etc. These technologies aim to improve the safety, efficiency, transparency and sustainability of maritime shipping.

These technological innovation and digitalization offer China some opportunities and advantages on its shipping routes, such as:

- Reducing human errors or accidents

- Optimizing operational performance or costs

- Enhancing data security or traceability

- Minimizing environmental impacts or emissions